In the ever-evolving global economic landscape, the phenomenon of billionaires serves as a barometer of wealth distribution, economic dynamism, and entrepreneurial spirit within nations. Tracking the distribution of billionaires across countries provides valuable insights into economic trends, policy environments, and the evolving nature of wealth creation. As of 2024, the distribution of billionaires has undoubtedly shifted, influenced by factors ranging from technological advancements to geopolitical developments. In this comprehensive analysis, we delve into the data to determine which country boasts the most billionaires in 2024 and explore the underlying factors driving this phenomenon.

The Rise of Billionaires:

The term “billionaire” was once a rare designation reserved for the elite few. However, over the past few decades, we have witnessed an unprecedented surge in the number of individuals amassing fortunes exceeding one billion dollars. This proliferation of billionaires can be attributed to various factors, including globalization, technological innovation, financial deregulation, and favorable tax regimes. The emergence of new industries such as technology, finance, and healthcare has created opportunities for individuals to accumulate vast wealth at an accelerated pace.

Methodology:

To ascertain which country has the most billionaires in 2024, we rely on data from reputable sources such as Forbes Billionaires List, Bloomberg Billionaires Index, and other industry reports. Our analysis encompasses a comprehensive review of the net worth, industry affiliations, and geographic distribution of billionaires worldwide. By synthesizing data from multiple sources, we aim to provide a robust and nuanced understanding of the global billionaire landscape.

Top Contenders:

- United States: Historically, the United States has dominated the global billionaire rankings, boasting a conducive environment for entrepreneurship, innovation, and wealth accumulation. Silicon Valley, Wall Street, and Hollywood serve as incubators for billion-dollar fortunes, with tech moguls, financiers, and entertainment tycoons commanding immense wealth. However, regulatory scrutiny, wealth inequality, and political polarization pose challenges to America’s status as the undisputed leader in billionaire wealth.

- China: China’s meteoric rise as an economic powerhouse has been accompanied by the emergence of a new breed of billionaires, fueled by the country’s rapid industrialization, technological prowess, and market reforms. The proliferation of internet companies, e-commerce platforms, and fintech giants has minted a new generation of Chinese billionaires, challenging the traditional dominance of Western counterparts. However, concerns regarding government intervention, regulatory crackdowns, and geopolitical tensions loom large over China’s billionaire class.

- India: India’s burgeoning economy and youthful demographics have catalyzed the ascent of billionaires across diverse sectors such as technology, manufacturing, and consumer goods. The IT boom, entrepreneurial ecosystem, and liberalization reforms have propelled Indian entrepreneurs onto the global stage, amassing significant wealth in the process. Despite socio-economic challenges and bureaucratic hurdles, India continues to produce billionaires at a steady pace, reflecting the country’s resilience and entrepreneurial spirit.

- Russia: Russia’s transition from communism to capitalism has spawned a cohort of billionaires with vast holdings in energy, natural resources, and telecommunications. The privatization of state-owned enterprises, coupled with favorable market conditions, has enabled oligarchs to amass immense fortunes, albeit amidst allegations of corruption, cronyism, and geopolitical tensions. The Russian billionaire landscape is characterized by opulence, influence, and close ties to the Kremlin, underscoring the intertwined nature of wealth and power in the country.

- Germany: Germany’s reputation as an industrial powerhouse is reflected in the wealth accumulation of its billionaire class, comprised of prominent figures in automotive, engineering, and retail sectors. Family-owned enterprises, Mittelstand companies, and multinational corporations form the bedrock of Germany’s economic success, with billionaires playing a pivotal role in driving innovation, exports, and job creation. However, demographic challenges, global competition, and technological disruptions pose formidable challenges to sustaining Germany’s billionaire status quo.

Analysis and Insights:

Upon analyzing the data, several key insights emerge regarding the distribution of billionaires in 2024:

- Sectoral Shifts: The composition of billionaire wealth reflects the evolving nature of industries, with tech, finance, healthcare, and renewable energy emerging as key wealth generators in the 21st century economy. Traditional sectors such as manufacturing, real estate, and retail continue to yield billionaires, albeit facing increasing competition from disruptive newcomers.

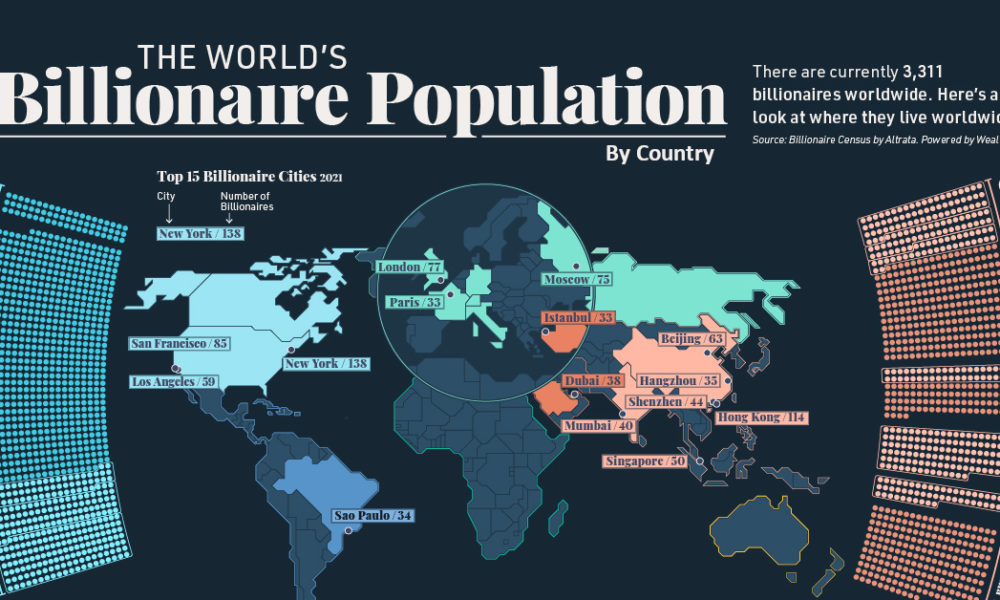

- Regional Dynamics: While the United States and China dominate the global billionaire rankings, other regions such as Europe, Asia-Pacific, and the Middle East are witnessing the rise of new billionaire hubs. Emerging economies in Southeast Asia, Latin America, and Africa are also producing billionaires, albeit at a slower pace, reflecting uneven economic development and structural constraints.

- Policy Implications: The concentration of wealth among billionaires has sparked debates regarding taxation, wealth inequality, and social responsibility. Governments worldwide are grappling with the challenge of balancing economic incentives for wealth creation with the imperative of ensuring equitable distribution of resources and opportunities.

Conclusion:

In conclusion, the distribution of billionaires in 2024 reflects the dynamic interplay of economic, technological, and geopolitical forces shaping the global landscape. While the United States retains its position as the epicenter of billionaire wealth, China, India, and other emerging economies are rapidly closing the gap, heralding a multipolar world of billionaire elites. Understanding the factors driving billionaire wealth creation is essential for policymakers, investors, and society at large to navigate the opportunities and challenges of an increasingly unequal world.

Through empirical analysis and qualitative insights, this article aims to shed light on the complex dynamics underpinning the global billionaire phenomenon, offering valuable perspectives for stakeholders seeking to navigate the intricacies of wealth creation and distribution in the 21st century. As the world continues to evolve, so too will the ranks of billionaires, reshaping the contours of global capitalism and the aspirations of future generations.